Dividend policy of Cyfrowy Polsat S.A. for the years 2022-2024

The main goal of the strategy of Cyfrowy Polsat S.A. Capital Group (the “Group,” “Polsat Plus Group”) is the permanent growth of the value of Cyfrowy Polsat S.A. (the “Company”) for its Shareholders. We intend to achieve this goal by implementing the major elements of our operational strategy which include:

- growth of revenue from services provided to individual and business customers through the consistent building of our customer base value by maximizing the number of users of our services as well as the number of services offered to each customer and simultaneously increasing average revenue per user (ARPU) and maintaining a high level of customer satisfaction;

- growth of revenue from produced and purchased video content by expanding its distribution, including a search for new channels of exploitation of rights, maintaining the audience shares of channels produced by us;

- use of opportunities arising from the advancing technological changes and market opportunities in order to expand the scope of our products and services;

- building a position on the clean, renewable energy market, in particular from the sun, wind, biomass, thermal waste treatment and building a complete value chain of a hydrogen-based economy, which creates opportunities to build a new stream of revenues for Polsat Plus Group and will bring tangible social benefits in the form of greenhouse gas emissions reduction;

- effective management of the cost base of our integrated capital group by exploiting its inherent synergies and economies of scale, and

- effective management of the Group’s finances, including its capital resources.

Predictable dividend payouts to Shareholders is one of the main goals underlying the capital resources management policy of the Company. At the same time, bearing in mind the goal to achieve and maintain a low level of indebtedness, designated by the General Meeting of Shareholders in the Articles of Association of the Company (the “Target Leverage Ratio”), the Management Board of the Company is obligated to formulate the financial policy of Polsat Plus Group in such a way, so as to meet the expected Target Leverage Ratio.

In view of the above, the Management Board of the Company intends to present a proposal concerning dividend payout together with the Management Board’s recommendation to the General Meeting annually, subject to the observance of the following general principles:

- the amount of a dividend paid out every year shall guarantee an attractive return on invested capital to the Company’s Shareholders;

- the level of the obtained return shall be shaped in relation to the commonly available on the Polish market forms of safe investing of funds, in particular in relation to the level of bank deposits rates, while taking into account a risk premium associated with floating of Cyfrowy Polsat’s share prices on the Warsaw Stock Exchange;

- the annually submitted proposal for distribution of the Company’s net profit for the previous financial year should allow for the continuation of gradual reduction of the net debt of Polsat Plus Group in order to achieve the Target Leverage Ratio.

In regard to the above, after having reviewed the investment plans of Polsat Plus Group and evaluated the possibilities of allocating the expected cash resources of the Group with an aim to pay out dividends to the Shareholders of the Company, in the years 2022-2024 the Management Board of the Company intends to recommend to the General Meeting dividend payout in the total amount of not less than PLN 3.00 per share in three installments as follows:

- at least PLN 1.00 per share to be paid out from net profit generated in 2021;

- at least PLN 1.00 per share to be paid out from net profit generated in 2022;

- at least PLN 1.00 per share to be paid out from net profit generated in 2023.

Simultaneously, the Management Board underscores that every time when presenting a proposal for distribution of the profit for the previous year it will take into account the Group’s net profit, financial standing and liquidity, existing and future liabilities (including potential restrictions related to facility agreements and other financial documents), the assessment of the Group’s prospects in specific market and macroeconomic conditions, potential necessity of spending funds for the Group’s development, in particular through acquisitions and embarking on new projects within the framework of the Group’s strategy, one-off items, as well as valid legal regulations.

The dividend policy will be subject to regular verification by the Company’s Management Board. The new dividend policy will take effect from January 1, 2022.

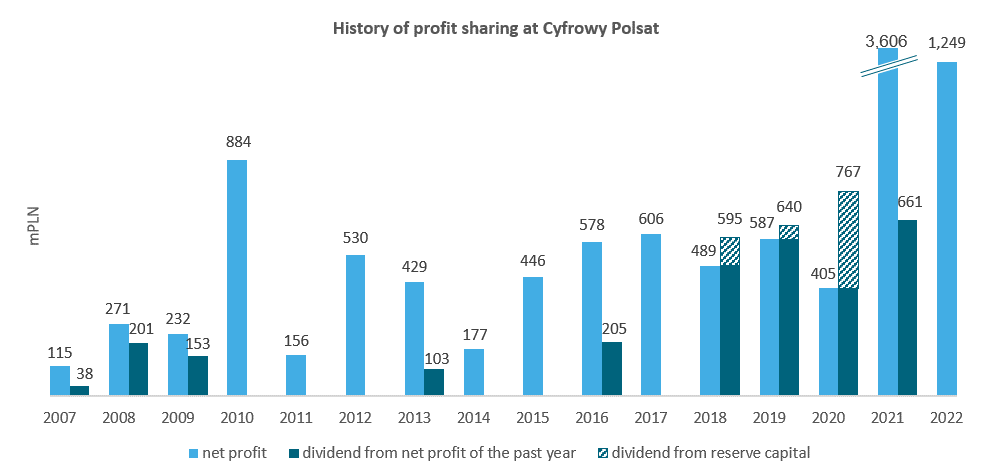

2022

Without dividend (allocated to reserve capital)*

| 2022 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN |

1,248,575,921.33 |

0 | 0 | - | - |

2021

Paid

| 2021 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

|

PLN |

3,605,855,418.23 |

660,844,237.20 |

1.20 | 20 September 2022 |

15 December 2022 |

2020

Paid

| 2020 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

|

PLN |

404,982,013.92 |

767,455,219.201 |

1.20 | 15 September 2021 |

28 September 2021 - 1st tranche |

[1] In accordance with the resolution of the General Meeting, includes PLN 362,473,205.28 from the reserve capital created from profits earned in previous years.

2019

Paid

| 2019 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

|

PLN |

586,802,125.73 | 639,546,016.001 | 1.00 | 15 October 2020 |

22 October 2020 - 1st tranche |

[1] In accordance with the resolution of the General Meeting, includes PLN 52,743,890.27 from the reserve capital created from profits earned in previous years.

2018

Paid

| 2018 | Net profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

|

PLN |

488,520,113.73 | 594,777,794.881 | 0.93 | 1 July 2019 |

3 July 2019 - 1st tranche |

[1] In accordance with the resolution of the General Meeting, includes PLN 106,257,681.15 from the reserve capital created from profits earned in previous years.

2017

Without dividend (allocated to reserve capital)*

| 2017 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 605,963,020.33 | 0 | 0 | - | - |

2016

Paid

| 2016 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 577.955.495,16 | 204,654,725.12 | 0.32 | 20 July 2017 | 3 August 2017 |

2015

Without dividend (allocated to reserve capital)*

| 2015 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 446,146,891.55 | 0 | 0 | - | - |

2014

Without dividend (allocated to reserve capital)*

| 2014 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 177,213,590.79 | 0 | 0 | - | - |

2013

Paid

| 2013 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 429,012,674.99 | 102,859,516.76 | 0.26 | 22 May 2014 | 6 June 2014 |

2012

Without dividend (allocated to reserve capital)*

| 2012 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 529,837,249.45 | 0 | 0 | - | - |

2011

Without dividend (allocated to reserve capital and to cover losses from previous years)*

| 2011 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 156,092,789.88 | 0 | 0 | - | - |

2010

Without dividend (allocated to reserve capital)*

| 2010 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| PLN | 884,165,232.13 | 0 | 0 | - | - |

2009

Paid

| 2009 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| 232,040,914.16 | 152,945,250.00 | 0.57 | 19 July 2010 | ||

| I installment | 101,963,500.00 | 0.38 | 19 July 2010 | 11 August 2010 | |

| II installment | 50,981,750.00 | 0.19 | 19 July 2010 | 17 November 2010 |

2008

Paid

| 2008 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| 271,277,066.74 | 201,243,750.00 | 0.75 | 1 June 2009 | ||

| I installment | 134,162,500.00 | 0.50 | 1 June 2009 | 16 June 2009 | |

| II installment | 67,081,250.00 | 0.25 | 1 June 2009 | 21 October 2009 |

2007

Paid

| 2007 | Net Profit | Dividend | Dividend per share | Dividend date | Dividend pay-out date |

|---|---|---|---|---|---|

| 115,038,239.62 | 37,565,500.00 | 0.14 | 18 July 2008 | 5 August 2008 |